The Supply Chain Impact On The 4th of July Fireworks Sales

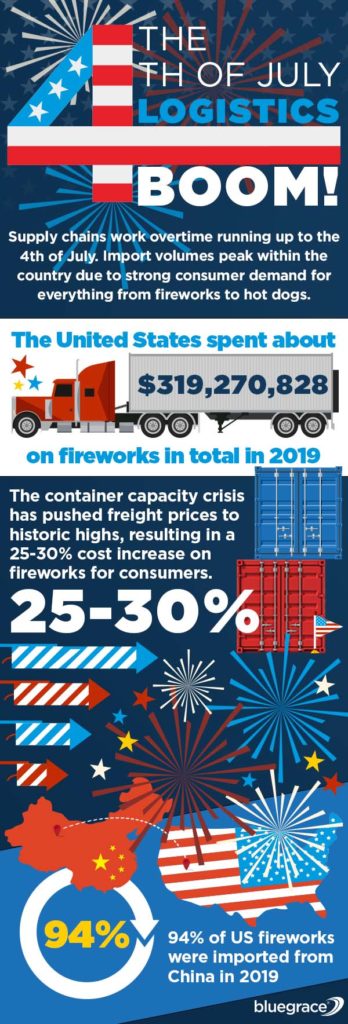

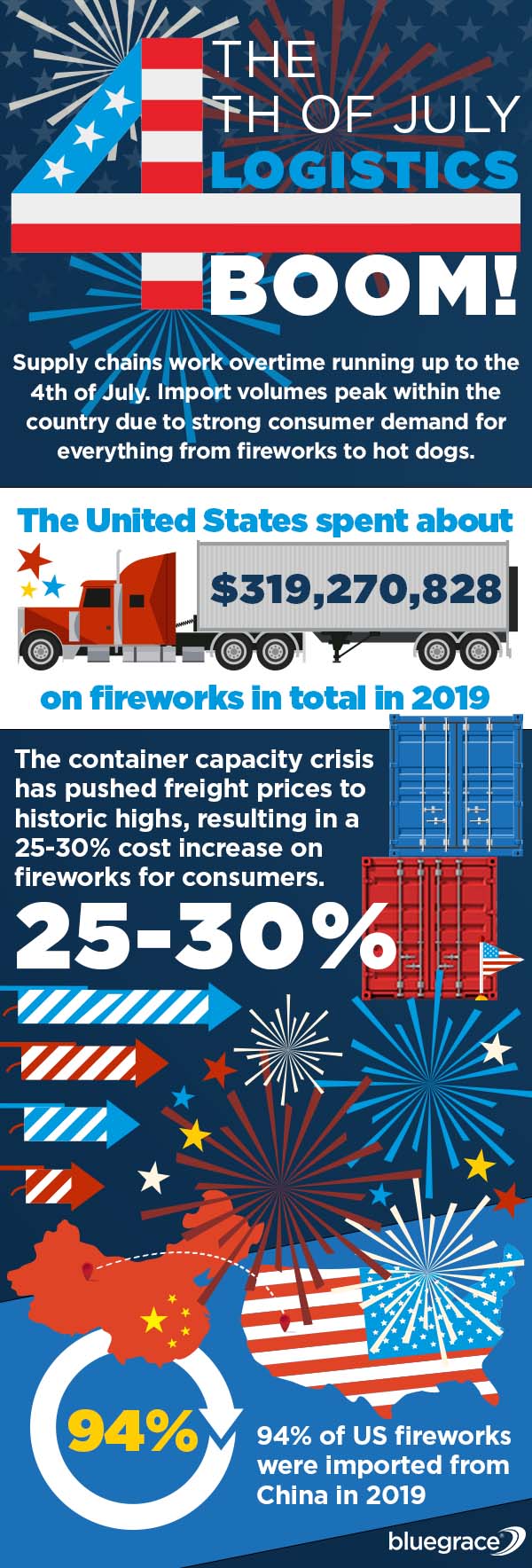

While the economy has picked up this year with US import volumes staying steadily at elevated levels, this reality to supply chains has been quite sobering. For one, widespread global logistics disruption has meant shippers could not find enough capacity for their freight to the US. The container capacity crisis exacerbated over the year, pushing freight prices to historic highs.

The FBX freight index showed a 153% gain over the last year in the China to West Coast N.America trade lane freight prices, while the China to East Coast N.America witnessed a 200% gain. The last few months have been especially challenging for maritime transport. Events like the Suez Canal crisis and the currently flaming Yantian port crisis acted as fuel to an already-worsened freight environment.

Accounting for this is critical as China was responsible for 94% of all US firework imports, amounting to roughly $315 million of the total $336 million spent in 2019. This means that as prices of freight containers crossing the Pacific increased, the prices of fireworks rose as well.

Personal fireworks sales were at historic highs last year, thanks to people remaining at home and ending up buying fireworks to celebrate themselves. This year, the celebrations are expected to be bigger. President Biden has been encouraging people to celebrate nationwide, to mark the return of relative normalcy in America after 16 months of the pandemic. Firecracker companies will find it challenging to manage domestic demand with supply that is a lot more expensive to transport than previous years.

E-commerce Spillover Disruption To Finding 4th of July Freight Capacity

The presence of e-commerce in the retail equation has never been more apparent. The e-commerce industry got a shot in the arm with the onset of the pandemic, as people locked indoors started going online to buy their products. This led to a surge in e-commerce sales through ‘20, with it continuing this year as well.

E-commerce will play a significant role during the 4th of July consumer shopping spree. This apart, the Amazon Prime Day that will be on June 21 will play a part in constricting capacity further. Amazon controls roughly 40% of all US e-commerce sales, making Prime Day a major event that could set off a ripple effect due to the volume spillover it would inevitably lead to. This spillover will primarily manifest across trans-Pacific trade lanes, derailing the 4th of July freight capacity needs.

Phantom Fireworks, a major fireworks seller in the US, stated their shipments were arriving late in California due to port delays. These delays were further extended due to capacity shortage in trucking and rail freight space. This has caused an issue with getting supplies, consequently resulting in a price rise for fireworks this year. In a discussion on shortages, fireworks would not be an exception. Every item that is a staple during the 4th of July celebration would possibly be in short supply – and, if available, be more expensive this year.