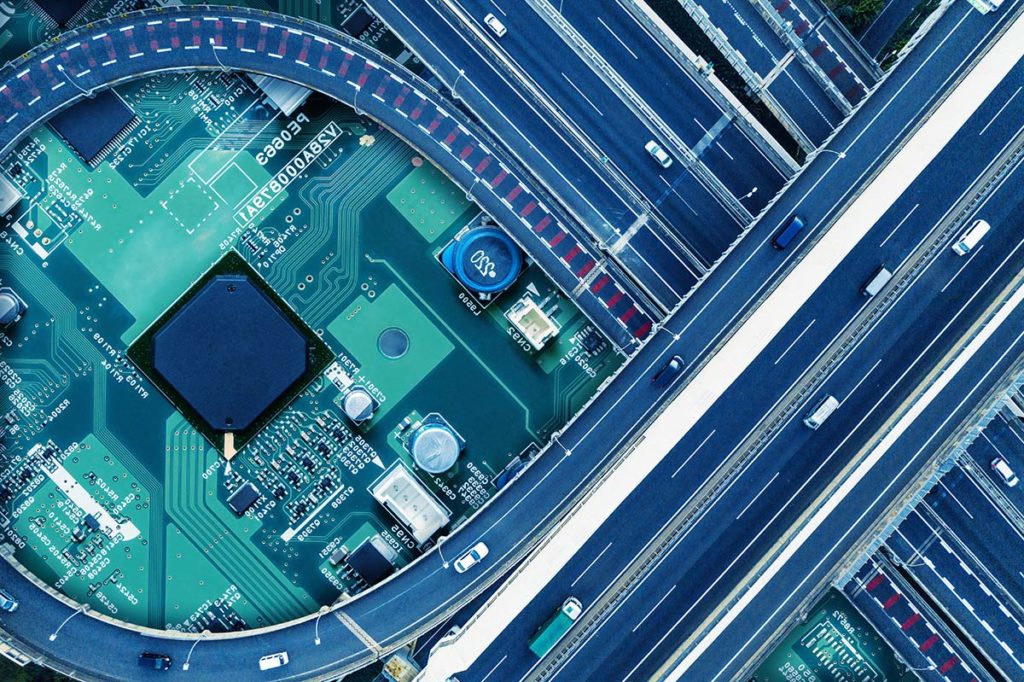

The global supply chain has been in the process of evolving over the past couple of decades. What was once a lumbering beast is now gearing itself into something decidedly more agile. It’s that evolution in the supply chain that is driving changes in business practices. The modern supply chain needs to be more agile, not only to keep up with consumer expectations but to keep abreast of fluctuations and disruptions as a whole.

As for retail stores, you can’t sell what you don’t have, and empty shelves mean missed profits, as well as running the risk of damage reputations and customer loyalty.

Fluctuations and supply chain disruptions can cost a company dearly. When a production line is shut down due to missing an inbound shipment, that could result in a loss of tens of thousands of dollars in both production time and man hours, not to mention shaving down precious lead time which can never be truly made up. As for retail stores, you can’t sell what you don’t have, and empty shelves mean missed profits, as well as running the risk of damage reputations and customer loyalty.

Cutting costs is just a matter of good business practice.

Efficiency will always have a place within the supply chain. Cutting costs is just a matter of good business practice. Building in agility, however, takes a bit more consideration and planning to do effectively. It’s a matter of balancing the need for cost-cutting, while being able to respond to new market conditions on the fly. It also means being able to overcome other challenges inherent within the supply chain, such as demand spikes, trade tariffs and more stringent trade agreements, as well as growing capacity shortages.

Agility Training

By putting agility in the forefront both shippers and 3PLs are able to position themselves to handle various market demands quickly and efficiently. Additionally, understanding the demands of particular customers, they can create “segmented experiential supply chains” to meet the ever-changing demands for a wide array of consumer needs. For most successful supply chains, third-party logistics providers are continuing to push upstream within the shipper’s supply chain to work directly with customers. This interaction allows a 3PL to help a shipper overcome the challenges that come with high delivery expectations and potential upswings or spikes in demand.

Cost will always be a determining factor for most companies, not just for shippers, but logistics providers as well.

According to the annual Third Party Logistics Study, many shippers say they understand the need for agility. However, “39% said they haven’t made changes to increase their inherent agility over the past five years and 15% reported decreasing supply chain nimbleness to reduce cost.” Cost will always be a determining factor for most companies, not just for shippers, but logistics providers as well. According to the survey, both parties said that it was the main factor in their decision-making process. “To help improve service and reduce costs, respondents said they are willing to try new approaches to the supply chain, with more than half of shippers—51%—saying nothing is off of the table and they are willing to evaluate all pieces of the supply chain.”

Breaking Away From Tradition

One of the biggest things that we need to realize is that we’re in the middle of a paradigm shift. Old business models are quickly burning out. Just look at retail stores like Toys R’ Us and Bon Ton, both of which have closed their doors for good. Retail stores that are willing to break away from the “tried-and-true” and willing to embrace the new way of thinking will thrive. This breaking away from tradition applies to more than just retail stores though. Even logistics companies will have to shake things up if they want to stay at the top of the food chain.

“The desire to reduce costs, improve delivery times and optimize networks is driving a willingness to eschew traditional business rules, particularly with tightening capacity in the trucking industry,” the Annual Report said. “When there is no capacity, those conversations change. Today the focus is on maximizing utilization and resources as they are becoming more limited and moving products to the end user in the most economical way.”

Getting the most from current resources will be crucial in the near future, especially when it comes to freight transportation.

Getting the most from current resources will be crucial in the near future, especially when it comes to freight transportation. Capacity has been running tight and will only continue to do so. While that’s great for trucking companies, as they can pick and choose the loads they want to take, shippers are going to have a harder time meeting delivery deadlines all the same. As capacity continues to tighten and the driver shortage gets worse, shippers will need to take a long hard look at working with logistics partners who have a broad reach. “A shipper may have a wonderful supply chain department, but they’re not going to have the utilization. A 3PL will have a diverse set of customers and large bases they can work with.”

(Re)Examining the Supply Chain

One of the strategies that we’ve helped our partners to employ is understanding their distribution density, or “center of gravity.” The better you understand your customer base, the easier it is to make smarter decisions about how to move freight. One of the most efficient ways to cut costs while increasing the agility of the supply chain is to reconsider where your distribution centers are.

While a massive warehouse might hold more shippable goods and products, having to haul it a longer distance repeatedly ends up eating into profit margins.

While a massive warehouse might hold more shippable goods and products, having to haul it a longer distance repeatedly ends up eating into profit margins. To that end, many shippers are looking into smaller distribution centers located closer to their denser customer regions. Even Walmart is making some big moves to help back it’s online fulfillment orders, by turning many of it’s Sam’s Club retail locations into regional distribution centers. “Among shippers, the most common business events that trigger their firm to re-examine its supply chain include changes in performance (71%), mergers and acquisitions (54%), new market entries (54%) and new product launches (48%),” the annual survey said.

Whether it’s finding available capacity, collecting the necessary data to streamline the supply chain, or identifying your center of gravity, BlueGrace is ready to help. Contact us at 800.MYSHIPPING or fill out the form below to speak to one of our freight experts today!